If you lose money gambling, you might be able to deduct it on your tax returns. However, before you can claim the deduction, you'll have to meet two important requirements. First, the IRS will want you to itemize all of your deductions. Second, you can only deduct gambling losses to the extent that you have gambling winnings.

For this purpose, the definition of gambling losses has been broadened to include other expenses incurred in gambling activities, such as travel back and forth from a casino or track. Let’s recap the basic rules. For starters, you can only deduct losses up to the amount of your winnings, so any excess loss can’t offset other highly taxed.

Claiming the Gambling Deduction

The way that you claim the gambling deduction is relatively simple. First, you have to file Schedule A and itemize your tax deductions. This means that you can't claim the standard deduction, but you can write off expenses like your state income tax, mortgage interest, property taxes, car registration tax and charitable donations. If you have gambling losses, you write them off as 'other miscellaneous deductions' on line 28 of Schedule A, where they get combined with your other itemized deductions to reduce your taxable income.

Deduction Rules

The IRS will only let you deduct losses to the extent that you win. For instance, if you lose $3,000 on one trip to the casino and win $2,100 on another trip in the same year, you can write off $2,100 in losses to offset the $2,100 in winnings, leaving you with a total of $900 of taxable gambling income. If you lost $1,000 on one trip and won $9,500 on another, though, you could claim the entire $1,000 in losses to reduce your net income from gambling to $8,500.

Proving Your Gambling

If you claim a gambling loss deduction, you will have to prove that you are entitled to it. Casinos send a form W-2G when you win to let the IRS know that they paid you, but it's up to you to establish your losses. The IRS requires you to keep tickets or receipts and a diary of your winnings and losses to substantiate your deduction. If you can get a printout from the casino of your gambling activity, such as if you use a player's club card, it may be helpful.

Professional Gambling

The rules for professional gamblers are different. A professional gambler makes a business out of gambling. He can write off his gambling losses and any expenses that he incurs for gambling -- like travel -- to offset gambling income. Since gambling is a business, he would file a Schedule C to report his income and expenses and would also have to pay self-employment taxes on his profits.

Video of the Day

References

About the Author

Steve Lander has been a writer since 1996, with experience in the fields of financial services, real estate and technology. His work has appeared in trade publications such as the 'Minnesota Real Estate Journal' and 'Minnesota Multi-Housing Association Advocate.' Lander holds a Bachelor of Arts in political science from Columbia University.

Photo Credits

- John Howard/Digital Vision/Getty Images

READ THESE NEXT:

Do you like to gamble? Do you ever win? If the answers to these questions are 'yes,' you need to know about deducting your gambling losses.

All Gambling Winnings Are Taxable Income

All gambling winnings are taxable income—that is, income that is subject to both federal and state income taxes (except for the seven states that have no income taxes). It makes no difference how you earn your winnings, whether at a casino, gambling website, Church raffle, or your friendly neighborhood poker game.

It also makes no difference where you win: whether at a casino or other gambling establishment in the United States (including those on Indian reservations), in a foreign country such as Mexico or Aruba, on a cruise ship, Mississippi river boat, or at a gambling website hosted outside the U.S. As far as the IRS is concerned, a win is a win and must be included on your tax return.

All Your Winnings Must Be Listed On Your Tax Return

If, like the vast majority of people, you’re a recreational gambler, you’re supposed to report all your gambling winnings on your tax return every year. You may not, repeat NOT, subtract your losses from your winnings and only report the amount left over, if any. You’re supposed to report every penny you win, even if your losses exceeded your winnings for the year.

Gambling Losses May Be Deducted Up to the Amount of Your Winnings

Fortunately, although you must list all your winnings on your tax return, you don't have to pay tax on the full amount. You are allowed to list your annual gambling losses as an itemized deduction on Schedule A of your tax return. If you lost as much as, or more than, you won during the year, you won't have to pay any tax on your winnings. Even if you lost more than you won, you may only deduct as much as you won during the year.

However, you get no deduction for your losses at all if you don’t itemize your deductions—just one of the ways gamblers are badly treated by the tax laws.

You Need Good Records

As the above rules should make clear, you must list both your total annual gambling winnings and losses on your tax return. If you’re audited, your losses will be allowed by the IRS only if you can prove the amount of both your winnings and losses. You’re supposed to do this by keeping detailed records of all your gambling wins and losses during the year. This is where most gamblers slip up—they fail to keep adequate records (or any records at all). As a result, you can end up owing taxes on winnings reported to the IRS even though your losses exceed your winnings for the year.

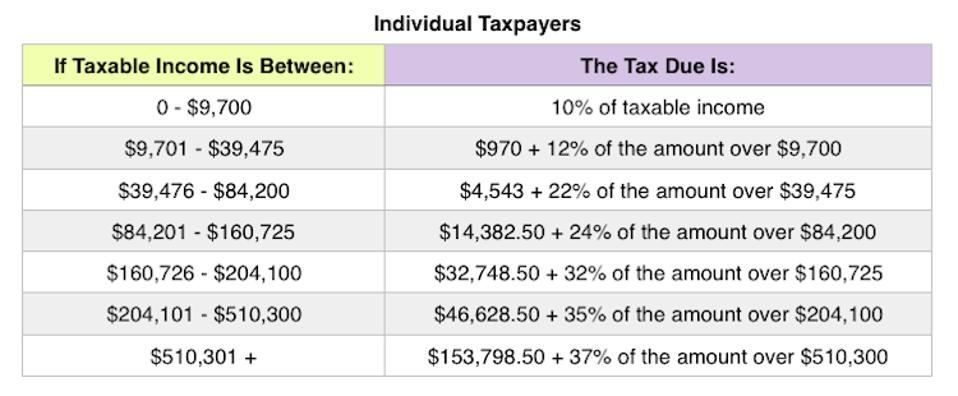

This has happened to many gamblers who failed to keep records. For example, Bill Remos, a Coca-Cola delivery driver in Chicago, gambled for fun and got lucky: He won $50,000 in a single game of blackjack. When Remos filed his taxes for the year he didn’t report the $50,000 win as income. Why? He knew he had at least $50,000 in gambling losses during the year. He subtracted his losses from his winnings and ended up with zero; so he figured he didn’t have any gambling income to list on his return. Makes sense, doesn’t it? Not to the IRS. Remos was audited by the IRS. Because he failed to follow the rules and couldn’t document his losses, he had to pay income tax on his entire $50,000 blackjack win. He ended up owing the IRS $17,000 in back taxes. This on an annual income of only $32,000!

Will the IRS Know?

Gambling is a cash business, so how will the IRS know how much you won during the year? Unfortunately for gamblers, casinos, race tracks, state lotteries, bingo halls, and other gambling establishments located in the United States are required to tell the IRS if you win more than a specified dollar amount. They do this by filing a tax form called Form W2-G with the IRS. You’re given a copy of the form as well. When a W2-G must be filed depends on the type of game you play. For examplle, the casino must file a W2-G if you win $1,200 or more playing slots; but only if you win $1,500 or more at keno. Thus, if you have one or more wins exceeding the reporting thrseshold, the IRS will know that you earned at least that much gambling income during the year. If this income is not listed on your tax return, you’ll likely hear from the IRS.

Gambling Losses New Tax Plan

The Rules Differ for Professional Gamblers

Irs Gambling Losses

If you gamble full-time to earn a living, you may qualify as a professional gambler for tax purposes. Professional gamblers inhabit a different tax universe than those who gamble for fun. In general, gambling pros are treated better by the IRS than amateurs, but few people qualify as gambling professioanls.